Wearable Payment Solutions: A Glimpse into the Cashless Future

1 March 2025

Technology has always shaped the way we live. We went from bartering goods to exchanging coins, then paper bills, to swiping plastic cards, and now… we’re paying with our wrists? Yes, you read that right! Wearable payment solutions are quickly becoming the next frontier in how we make transactions. It's like something straight out of a sci-fi movie, except it's happening right now, and it’s way cooler than we could have imagined.

In this article, let's dive into the world of wearable payment solutions, how they work, and why they're quickly becoming a staple in the cashless future. Whether you're someone who's already rocking a smartwatch with payment capabilities or you're just curious about what the fuss is all about, you're in the right place.

What Are Wearable Payment Solutions?

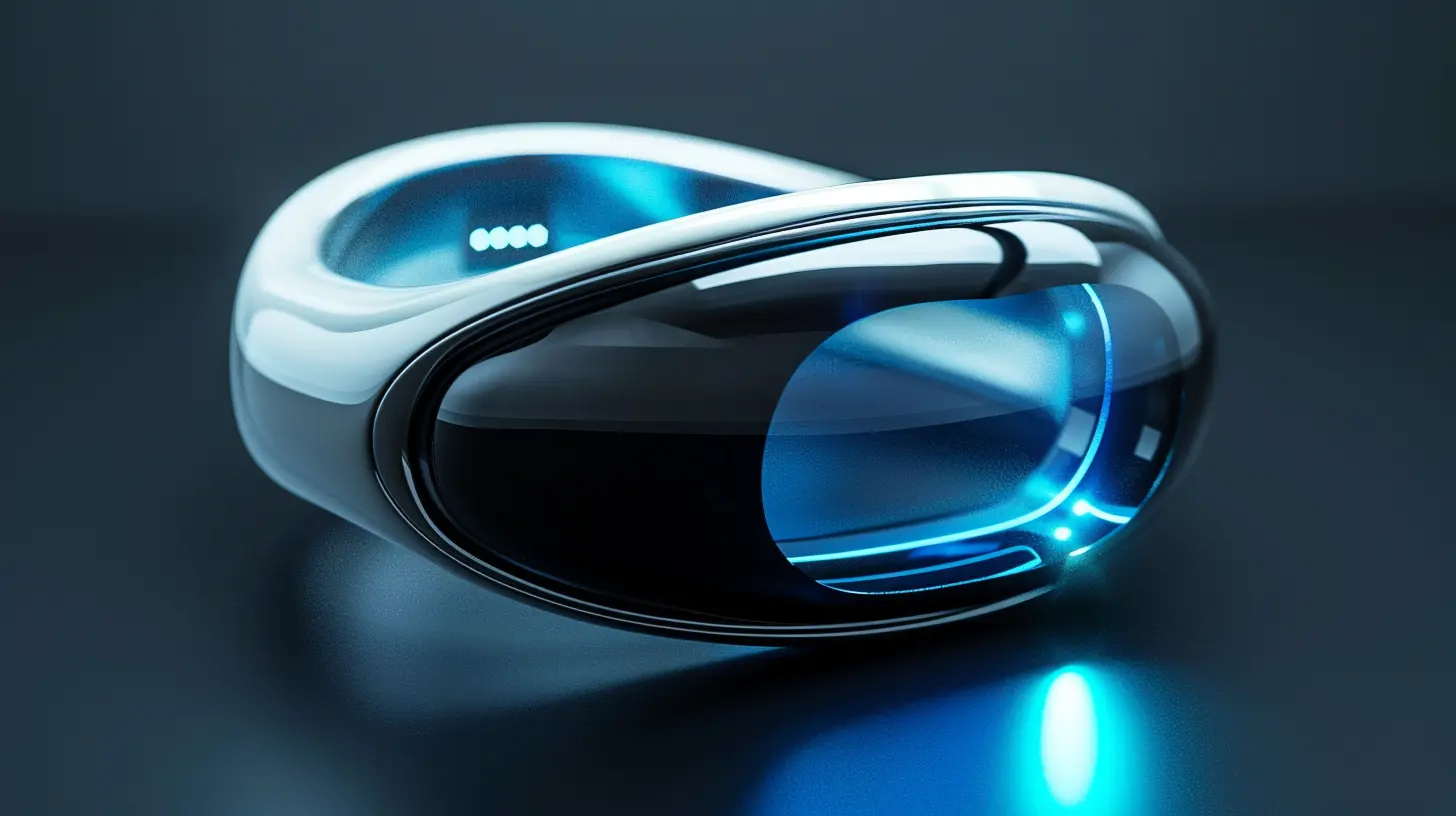

Before we get too deep, let’s start simple: What exactly are wearable payment solutions?Wearable payment solutions allow you to make purchases using a device that you wear on your body. This could be a smartwatch, a fitness tracker, or even a ring (yes, a ring!). These wearables have embedded technology, like NFC (Near Field Communication) or RFID (Radio-Frequency Identification), that allows them to communicate with payment terminals. In simpler terms, they let you tap and pay without needing to pull out your wallet or phone. Pretty handy, right?

It’s all about convenience and efficiency. You can leave your wallet at home, and when you’re at the checkout counter, a quick wave of your wrist or tap of your ring processes your payment in an instant.

How Do Wearable Payments Work?

Great question! Wearable payments work similarly to how contactless credit cards function. Most wearables use NFC technology, which is the same tech that powers Apple Pay, Google Pay, and Samsung Pay.Step-by-Step Breakdown:

1. Prepping the Wearable: First, you link your credit card or bank account to the wearable device through an app. For instance, if you're using an Apple Watch, you’d set up your card in the Wallet app.2. Making the Payment: When you’re ready to make a purchase, you simply bring your wearable device near the payment terminal. The device communicates wirelessly with the terminal using NFC.

3. Transaction Process: The contactless payment system verifies your device and processes the transaction. Often, the wearable will vibrate or give some signal that the payment went through.

4. Security Measures: Most wearables use tokenization and encryption for security. This means your actual card details are never shared with the merchant. Instead, a unique "token" is used each time you make a transaction, keeping your financial information safe.

Types of Wearable Payment Devices

There’s no one-size-fits-all when it comes to wearable payments. From smartwatches to fitness bands, there’s a growing array of devices you can use to make seamless transactions.1. Smartwatches

The most popular wearable payment devices by far, smartwatches like the Apple Watch, Samsung Galaxy Watch, and Fitbit Versa integrate payment systems like Apple Pay, Google Pay, and Fitbit Pay, respectively. These devices are not just for telling time or counting steps—they’ve become mini wallets on your wrist.2. Fitness Trackers

Devices like the Garmin Vivosmart or Fitbit Charge go beyond just tracking your workouts. Many of these fitness trackers now come with NFC capabilities, allowing users to make payments while out for a jog or hitting the gym.3. Wearable Rings

Yes, you read that right. Companies like K Ring and Token have introduced wearable payment rings. Imagine paying for your coffee by simply tapping your finger on the payment terminal. It’s subtle, sleek, and incredibly futuristic.4. Smart Clothing and Accessories

While still in its early stages, smart clothing—such as jackets or gloves with embedded payment technology—is on the horizon. These innovations could revolutionize how we think about wearables, taking the concept beyond devices and into the very fabric we wear.

The Benefits of Wearable Payment Solutions

Now that we’ve covered the basics, let’s talk about why wearable payment solutions are gaining so much traction. Here are some of the key benefits:1. Convenience

Imagine this: You’re out for a morning run, and you stop by a café for a quick coffee. You don’t have to fish around for your wallet or phone; you just tap your wrist. Wearable payments make life easier, especially in situations where carrying a wallet or phone is impractical.2. Speed

Tapping your wrist or ring on a payment terminal is much faster than pulling out a card, inserting it, and waiting for approval. The speed of wearable payments makes them perfect for busy, on-the-go lifestyles.3. Security

Wearable payment devices often use biometric authentication (like a fingerprint or heart rate sensor) or a PIN code to approve transactions. Plus, the encryption and tokenization methods used add an extra layer of security. In fact, some argue that wearable payments are safer than using a traditional credit card.4. Hygiene

In a post-pandemic world, contactless payments have become more appealing for hygienic reasons. Wearable payments reduce the need for physical contact with cash or even payment terminals.5. Hands-Free

Ever been juggling groceries, a purse, or a briefcase, and then had to dig around for your wallet? Wearable payments eliminate that hassle. A quick tap of your wrist, and you're good to go.The Challenges of Wearable Payment Solutions

Of course, like any technology, wearable payments aren’t without their challenges.1. Compatibility Issues

Not all merchants have upgraded to contactless payment terminals. While NFC technology is becoming more widespread, there are still places where you’ll need to rely on traditional payment methods.2. Battery Life

Most wearable devices need to be charged regularly. If your smartwatch or fitness tracker runs out of battery, then so does your ability to make payments.3. Cost of Entry

The price of wearable payment devices can be a barrier for some consumers. High-end smartwatches can cost several hundred dollars, making the convenience of wearable payments a premium feature.4. Privacy Concerns

While wearable payments are secure, some users may be concerned about privacy. Wearable devices collect a lot of data, and depending on the manufacturer, there's always the potential for misuse or data breaches.The Growing Adoption of Wearable Payments

The adoption of wearable payment solutions is growing rapidly, and it’s not just in tech-savvy cities. Across the globe, consumers are showing an increasing appetite for cashless and contactless payment options.1. Millennials and Gen Z Are Leading the Charge

Younger generations are more likely to adopt new technologies, and wearable payments are no exception. With a strong preference for convenience, speed, and digital solutions, Millennials and Gen Z are helping to drive the shift towards wearables.2. Post-Pandemic Shift

The COVID-19 pandemic accelerated the shift towards cashless payments. Concerns about hygiene and the spread of germs made contactless payments more appealing. Wearable payment solutions fit perfectly into this new normal where fewer people want to handle cash or touch public surfaces.3. Retailers are Catching Up

Many retailers have already upgraded to NFC-enabled payment terminals. In fact, major chains like Starbucks, Walmart, and McDonald's have embraced contactless payments, making it easier for consumers to use wearable payment devices.The Future of Wearable Payments

So, where is all this headed? It’s clear that wearable payment solutions are just getting started. As technology evolves, these devices will likely become even more integrated into our lives.1. More Devices, More Innovation

Expect to see more wearables with payment capabilities, from smart glasses to embedded jewelry. Tech companies are constantly pushing the boundaries, and wearable payments will likely extend beyond wristwatches and fitness trackers.2. Integration with Other Services

Wearable payments may soon be integrated with other services beyond just retail. Imagine paying for public transportation, unlocking your car, or even accessing your home with a simple tap of your wearable device.3. Global Expansion

Right now, wearable payments are primarily used in developed countries, but as the infrastructure for contactless payments continues to grow, we’ll likely see increased adoption in developing markets as well.Conclusion

Wearable payment solutions are changing the way we think about money and transactions. These tiny devices offer a glimpse into a future where cash, cards, and even smartphones may become obsolete. The convenience, speed, and security they provide are hard to ignore, and as more people adopt this technology, the cashless future feels closer than ever.So, next time you’re out and about, look around—you might just spot someone paying for their coffee with a flick of the wrist or a tap of their finger. It’s not magic; it’s the future, and it’s already here.

all images in this post were generated using AI tools

Category:

Wearable TechAuthor:

John Peterson

Discussion

rate this article

18 comments

Pandora Bailey

This article offers an insightful perspective on the evolution of wearable payment solutions. It's exciting to see how technology is shaping a cashless future, making transactions more convenient and secure for everyone.

April 2, 2025 at 1:02 PM

John Peterson

Thank you for your thoughtful feedback! I'm glad you found the article insightful and exciting. The evolution of wearable payment solutions truly marks a significant step towards a more convenient and secure cashless future.

Samira Smith

Revolutionizing transactions, wearables enhance convenience and security significantly.

March 30, 2025 at 3:34 AM

John Peterson

Thank you! Wearables truly are transforming how we approach payments, making transactions more seamless and secure.

Tristan Lawson

Wearable payment solutions are revolutionizing transactions, merging convenience with security, and paving the way for a truly cashless society.

March 28, 2025 at 8:47 PM

John Peterson

Thank you for highlighting the transformative impact of wearable payment solutions! They truly are at the forefront of creating a secure and convenient cashless future.

Zorina Strickland

This article highlights the exciting potential of wearable payment solutions. As technology evolves, embracing cashless options could redefine convenience and security in our daily transactions.

March 26, 2025 at 11:35 AM

John Peterson

Thank you for your insightful comment! I completely agree that wearable payment solutions are set to transform the way we approach convenience and security in our everyday transactions.

Nyxaris Lawson

As we strap on wearable payment solutions, the future of cashless transactions feels both thrilling and unsettling. While convenience is king, let’s pause to consider security and privacy. Will our wrists become the new wallets, or just an invitation for hackers? The future awaits!

March 26, 2025 at 3:57 AM

John Peterson

Thank you for your insightful comment! Balancing convenience with security and privacy will indeed be crucial as we embrace wearable payment solutions. The future of payments is exciting, but we must ensure safeguards are in place to protect users.

John Cantu

Forget the wallet—soon we'll be paying with the blink of an eye or a well-timed eyebrow raise! Who knew our faces would become the hottest fashion accessory in the cashless revolution? Bring on the wearable wizardry!

March 25, 2025 at 1:54 PM

John Peterson

Thanks for your fun take! The evolution of payment technology is indeed exciting, and our faces may just become the ultimate payment accessory. Bring on the future!

Oliver McKellar

Cashless future? More like cashless *fabulous*! Who needs wallets when you can rock sleek wearables? Embrace the tech—just don’t forget to accessorize your payment game!" 💁♀️✨

March 25, 2025 at 4:13 AM

John Peterson

Absolutely! Wearable payment solutions are revolutionizing how we transact—making payments stylish and convenient. Cheers to the fabulous cashless future! 💳✨

Velvet Hudson

Exciting advancements in wearable payments promise a seamless, cashless future for consumers!

March 23, 2025 at 7:22 PM

John Peterson

Thank you! We're thrilled about the potential of wearable payments to enhance convenience and streamline transactions for consumers.

Whitney Porter

It's inspiring to see technology evolve towards convenience and accessibility. Embracing wearable payment solutions could truly enhance our daily lives and empower more people.

March 22, 2025 at 7:19 PM

John Peterson

Thank you for your insight! Indeed, wearable payment solutions have the potential to significantly enhance convenience and inclusivity in our daily transactions.

Maria Mendoza

Who needs pockets when your wrist can pay for coffee? Wearable payment solutions are like magic wands for your wallet—wave goodbye to cash and hello to convenience!

March 21, 2025 at 9:16 PM

John Peterson

Absolutely! Wearable payment solutions truly transform our spending experience, making transactions effortless and redefining convenience in our cashless future.

Rhiannon Good

Finally, my watch can splurge!

March 9, 2025 at 8:33 PM

John Peterson

Absolutely! Wearable payment solutions are revolutionizing convenience and style. Enjoy your splurge!

Merida McAlister

Wearable payment solutions are revolutionizing the way we transact. Embracing this technology not only enhances convenience but also signifies a pivotal shift towards a truly cashless future. The time to adapt is now!

March 7, 2025 at 3:27 AM

John Peterson

Thank you for your insightful comment! I completely agree—wearable payment solutions are indeed a game-changer in creating a seamless cashless experience.

Vaughn McCord

Exciting times ahead! Wearable payments are revolutionizing convenience and making transactions a breeze!

March 5, 2025 at 9:35 PM

John Peterson

Absolutely! Wearable payments are indeed paving the way for a seamless cashless experience. Exciting developments lie ahead!

Kate Newman

Exciting times ahead! Wearable payments make transactions seamless and fun! Let's embrace it!

March 5, 2025 at 4:12 AM

John Peterson

Thank you! Exciting indeed—wearable payments are transforming how we transact, making convenience and fun a reality in our daily lives!

Sophia Phelps

Great insights! It's exciting to see how wearable payment solutions are shaping our financial interactions and embracing a cashless future.

March 2, 2025 at 9:31 PM

John Peterson

Thank you! I'm glad you found the insights valuable. Exciting times ahead for a cashless future!

Lucy Chapman

Great insights on the evolution of wearable payment solutions! As technology advances, it's exciting to envision a cashless future where convenience and security are seamlessly integrated into our daily lives. Looking forward to more developments in this space!

March 2, 2025 at 12:08 PM

John Peterson

Thank you! I share your excitement about the potential of wearable payment solutions to transform our daily transactions. Stay tuned for more updates!

Rina Potter

Wearable payment solutions are revolutionizing the way consumers engage with financial transactions. By integrating technology into everyday accessories, such as smartwatches and fitness bands, these innovations facilitate seamless, contactless payments. As adoption increases, we can expect a significant shift towards a cashless society driven by convenience and enhanced security.

March 2, 2025 at 4:49 AM

John Peterson

Thank you for your insightful comment! Indeed, wearable payment solutions are paving the way for a more convenient and secure cashless future.

Grayson Peterson

Embrace the future; wearables redefine payment convenience!

March 1, 2025 at 11:45 AM

John Peterson

Thank you! Wearables indeed promise to enhance payment convenience, making transactions seamless and efficient.

MORE POSTS

Developer Tools for Building Scalable Web Applications

Deepfakes and the Threat to Information Integrity

The Quiet Revolution: Silent Ultrabooks Without Fans

How IoT Networks Are Shaping the Future of Smart Cities

The Impact of Big Data on Social Media Marketing

The Role of Autonomous Vehicles in Reducing CO2 Emissions

The Ethics of Cybersecurity: Striking a Balance Between Privacy and Protection

What to Consider When Buying Headphones for Kids

How Wireless Charging Could Change the Way We Use Batteries

Portable vs. Studio Headphones: What’s the Difference?

Common Headphone Myths: Separating Fact from Fiction